FCP Newsletter – Q4 2021

London, February 2022

Dear Friends & Clients,

As we transition into the new year, we wanted to share a quick update on the three pillars of our business – our investment portfolio, our charity portfolio, and our team – as well as share a few reflections on developments we are observing in Private Markets and co-investment activity globally. The alternative investment industry in 2021 has seen peak fundraising and deployment activity, which has not surprisingly also resulted in record valuations. Our experience has been that at times like these, Principal-Agent temptations are at their highest, and the surge of agents and promoters offering ‘co-investments’ are in many cases selling the equivalent of unregulated and untested Class A drugs (unvetted deals offering the promise of ‘quick highs’) cynically disguised with the label of a historically lower risk, unassuming asset class. We therefore argue that its paramount to focus on the incentives of business counterparties as this is one of the most effective ways of mitigating risk.

New Year’s FCP Organisational Update

At year end, we reached the following exciting milestones:

Investment Portfolio. Whilst early days and still entirely unrealised, our portfolio is performing well, with a Net Asset Value of ~$121m representing a blended gross MoIC of 1.17x, or unweighted average gross MoIC of 1.40x and gross IRR of 51% [1].

Charity Portfolio. We are pleased to announce the addition of two new charity partners to our portfolio: Onside’s WEST Youth Zone and the Sean Parker Center for Allergy & Asthma Research at Stanford. Alongside our founding membership of Charity:Water’s Well and Pool programmes, this brings FCP’s carried interest pledges to our charity partners to 10%.

Team. We are pleased to announce the hiring of Manuel Balerdi, Associate, formerly with Banco Santander, who joins our execution team, as well as the imminent onboarding of Abi Waddington, Business Development Manager (formerly with the British Venture Capital Association), who will begin with FCP in March.

For those who are interested, further details on each can be found below:

1. Investment Portfolio Update

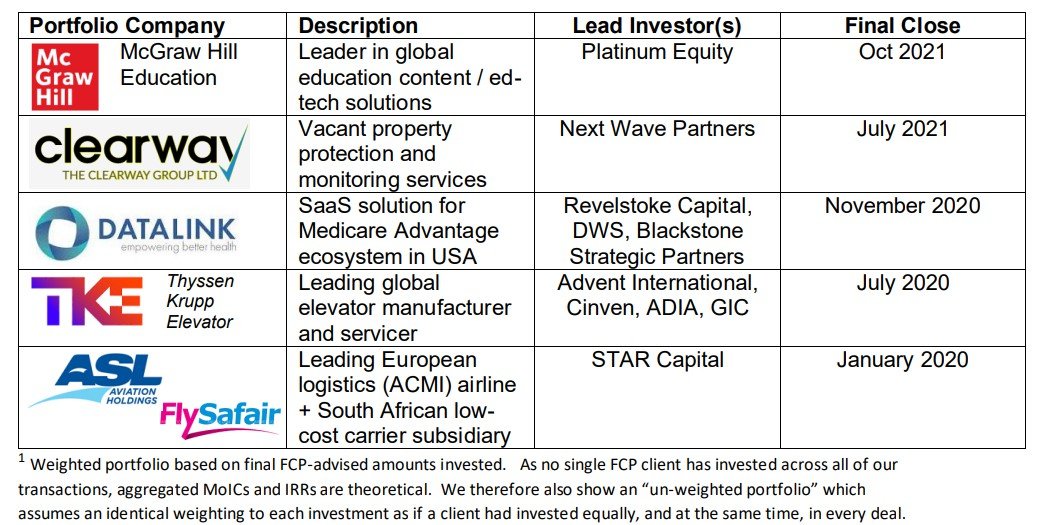

Following completion of our recent Q3 Valuations, we are pleased to report that the overall Net Asset Value of our portfolio sits at $120.8m, representing a blended gross MoIC of 1.17x, an unweighted average MoIC of 1.40x and an unweighted IRR of 51% [2]. As our last two transactions were completed in the last six months, are still held at cost, and happen to represent our two largest positions, we present a hypothetical “mature portfolio [3]” of transactions over one year old which boast a blended MoIC of 1.98x, an unweighted MoIC of 1.67x and an unweighted IRR of 48% [4].

Performance Highlights

Performance has been particularly strong in our inaugural co-investment in ASL Aviation alongside STAR Capital, which has unsurprisingly benefitted from the continued shifts towards e-commerce and online delivery in Europe through the Covid-crisis and lockdowns. The Company’s fleet of c.130 aircraft has remarkably achieved a 99.8% reliability rating despite the obvious logistical challenges posed by Covid quarantines and restrictions, and – in addition to its world leading express cargo operations - has served in several humanitarian missions throughout the crisis, such as delivering millions of N-95 masks from China to continental Europe during times of shortage, as well as repatriating thousands of Belgians and French nationals in the absence of scheduled commercial flights. In the meantime, its South African subsidiary FlySafair has flourished as the rest of the domestic carrier market has remained insolvent or grounded.

FCP’s investment in TKE alongside Advent International, Cinven, Abu Dhabi Investment Authority and GIC (Singapore’s SWF) continues to benefit from the resilience of elevator service contracts (these are required to take place by law / regulation in most jurisdictions) as well as the efforts of Advent and Cinven to execute on their Value Creation Plan.

Datalink has benefited from the US Medicare Advantage programme’s ongoing popularity in terms of new Medicare members coming online and opting for this ‘value-based care’ coverage option. Whilst FCP’s Clearway and McGraw Hill co-investments are under 6 months old and therefore ‘too early to tell’, the businesses are showing promising signs, including the closing of a recent e-learning acquisition at McGraw hill in November and an add-on acquisition in France for Clearway in December.

2. Charity Portfolio Update

Following our carried interest commitment towards Charity:Water’s leading efforts to solve the global water crisis, we have spent the past two years assessing a series of additional charitable organisations to grow FCP’s charity portfolio in lockstep with the growth of the rest of our organisation.

We felt it made sense to balance the international nature of our business and the global impact of Charity:Water’s work bringing clean water to millions of people around the world, with a subsequent commitment that was much closer to home, to our local community in London. We found a suitable and worthy partner in OnSide’s WEST Youth Zone, an incredible space for young people that will open in 2023 located only 3.5 miles from our offices in White City, Hammersmith. FCP has committed future Carried Interest to the project (which is chaired by Mark Davies, one of the founders of BetFair, and now Chair of British Rowing) to help fund, alongside its other Founder Patrons, the Youth Zone’s operating costs for the foreseeable future. As part of our due diligence, we toured another Youth Zone further south in Croydon, London and were blown away by the quality of the facilities, training and instruction available to local youth.

Closer to the end of the year, we were also approached by an organisation led by one of the US’s foremost paediatric allergy experts, Dr. Kari Nadeau, in relation to funding a UK trial focused on curing childhood food allergies. As one of our daughters suffers from multiple allergies of this kind, this was a cause particularly close to our family’s hearts. Finally, Dr. Nadeau’s reputation preceded her, as one of FCP’s clients had proactively introduced us to her a few years ago so the ground breaking nature of her work was already well known to us.

3. Team Additions

Q4 provided us a few weeks of downtime between deals during which we were able to focus on further building out our executive team. Manuel has just begun as an Associate, whereas Abi is scheduled to start as Business Development Manager in March.

Manuel Balerdi: Manuel joins FCP from Banco Santander, where he has served since 2019 as a Senior Investment Banking Analyst within the Debt Capital Markets team. In parallel, he provided volunteer assistance and support to Animarte, which promotes the inclusion of Argentinians with disabilities and seeks to enhance their active participation in society. He previously served as a Financial Analyst at AdCap Securities and prior to that at Deloitte. He holds a Bachelor of Economics and Finance from the University of San Andres (including an exchange semester at Università Bocconi in Milan).

Abi Waddington: Abi has spent the last eight years of her career as a senior manager of the British Venture Capital Association, where her role involved building event sponsorships and new membership via relationships with both GPs and LPs. Previously she worked with Blueprint Partners and iLUKA on guest and database management for events such as the Amnesty International 2013 AGM as well as the 2012 London Olympic and Paralympic Games. She holds a BA in Criminal Justice and Criminology from the University of Leeds.

Reflections on Private Markets and Co-investment activity

There are countless private markets commentators and tabulators, but almost all are in agreement that 2021 represented another all-time high not only for private equity fundraising, but notably also for direct and co-investment deployment and valuations.

The venerated placement firm Triago’s annual review summarises the trend succinctly, highlighting “for all of 2021, PE funds are on track to gather $945 billion, exceeding 2017’s apex by 14 percent”, with Direct & Co-investments “at a record 28 percent of fundraising, or an absolute all-time high”.

… so we believe it’s prudent to focus on two simple concepts: identifying and overcoming Principal-Agent conflicts and maximising Alignment of Interest

Whenever any asset class we have been involved in reaches record deployment and valuation levels, we reflect on the three economic cycles we’ve invested through over the last 25 years and try to take stock of what we’ve learned. Our experience has been that Principal-Agent conflicts tend to peak during these times – perhaps because competition for access tightens, and investors’ Fear of Missing Out (‘FOMO’) is particularly heightened during these times, causing standards of due diligence to lapse, and possibly because bad actors find it easier to hide amongst the crowds. As a result, our strategic priority going into 2022 is to redouble our traditional focus on maximising alignment of interest with our Lead GPs, as well as be almost forensic in our focus on our counterparties’ incentives and how these might impact their fiduciary tendencies.

A brief exploration of the Principal-Agent problem and how/where it manifests itself in Private Markets

In times like these, it’s helpful to reflect on the manifestations of Principal-Agent conflicts in private investing. We will divide our reflections into two parts. Firstly, there are the incentives faced by the three main parties in a Direct Investment itself: (i) Sellers and their advisors, (ii) Management Teams/Founders, and (iii) Buyers/Investors/Lead GPs (including funded GPs and Fundless Sponsors). Secondly, for the same Direct transaction, it’s equally important to carefully understand the incentives faced by the sources of a particular co-investment (GPs vs. agents and promoters).

1) Direct Investment Level-incentives

(i) Sellers & their agents

At the risk of stating the obvious, in any transaction, the basic incentive of a seller is to maximise selling price. They almost always have far more information than any other party around the table, and so due to this privileged vantage point, one must always ask serious questions about their motivation to sell in the first place. As they typically control and compensate Management and their advisors and agents, they are in a unique position to ‘spin’ a situation. Whilst sell-side advisors are typically incentivised via a % of proceeds, given the relatively smaller absolute amount they stand to gain, they somewhat counter-intuitively have more to lose reputationally from obfuscation or exaggeration than their clients, so can often be a welcome source of ‘balance’ when it comes to presenting a company for sale or investments. Sellers who have built a successful business are also typically affected by what is known as survivor bias, which seldom comes accompanied by balanced judgement and humility when assessing the outlook for their business. Nevertheless, the conflict between sellers and buyers is possibly the greatest in the entire private markets’ ecosystem, which is why as a matter of principle, FCP chooses to leave Direct Investing – ie. the hard work of sifting through the spin and the obfuscation of sellers – to only the most experienced Lead GPs who have decades of experience separating the wheat from the chaff, enjoy multi-million dollar due diligence budgets, and maintain a constant eye on their track records.

(ii) Entrepreneurs, founders and management teams

Rather than explore the conflicts faced by these ‘agents’ post-acquisition (to which a great deal of academic research and theory is dedicated), we’d like to focus purely on a management team’s incentives at the point when a Private Markets transaction takes place:

Firstly, how ‘equitized’ a particular founder or management team is, and/or how much money is being ‘taken off the table’ vs rolled over, may determine whether their incentives are closer to those of ‘sellers’ than ‘buyers’ using the categorisation above. Over the past decades, we have observed several instances of founders/management teams being complicit in overstating the current or future financials of their businesses when faced with the prospect of creating generational wealth (Who wouldn’t? Equity investors – by their nature – are typically ‘glass half full’ in their outlooks, and in particular, shortfalls from a forward-looking business plan can be explained away as being the result of unexpected surprises that invariably occur). The nobility of their causes notwithstanding, in our experience ‘first-time’ entrepreneurs and founders are particularly prone to this slippery slope, whereas serial entrepreneurs and seasoned corporate executives tend to focus more on their longer-term reputations and longevity. Our intention is not to denigrate a particular career choice, merely to point out that greater potential financial windfalls drive larger Principal-Agent conflict temptations.

Conversely, under-equitized management teams, or buy-in teams, find themselves on the completely opposite side of the table, with the majority of their compensation (and candidly career prospects) tied to the success of their new owners’ investments.

Finally, it’s worth remembering that not all ‘roll-overs’ are created equal. In most private equity deals, rolling founders/managers are often forced to reset their equity/options to the same value as their incoming owners (or at least to subordinate them to new, additional debt). Conversely, ‘unicorn’ founders and management teams’ options are typically not reset and, as a result, even though they may not be taking money off the table, a follow-on or pre-IPO round gets these individuals one step closer to what is typically the same multi-million (if not billion) generational wealth event that we concluded earlier before pushes them firmly into the ‘seller’ camp.

(iii) Lead General Partners

Firstly, we should recognise that all Lead GP’s face their own Principal-Agent temptations. However, their business models and wealth creation prospects are driven by entirely different factors than a typical founder/management team. Manager/founder equity is typically tied to one Company, whereas a Lead GP’s wealth is typically spread across three buckets: (i) carried interest in their funds (often across multiple, cross-collateralised companies); (ii) future compensation prospects (tied to the probability and size of their next fundraise); and (iii) ownership, if any, in their own franchise (their ‘GP stake’).

Unless a Lead GP’s franchise is coming to a close, and/or their carry-waterfall (the way their Partnership legals allow them to distribute gains) allows them to take capital off the table regardless of the performance of their other investments, we generally view Lead GPs as being very strongly aligned with their LPs and co-investors. This is the underlying reason behind FCP’s core focus on co-investing with only the most experienced and preferably upper quartile Lead GPs who face significant carry, fundraising, and franchise downside as a result of the underperformance of a single deal.

(iv) Fundless Sponsors

In our view, Fundless Sponsors face incentives more similar to those of Founders/venture management teams than their funded brethren – ie. their incentives are often skewed heavily towards a single company or project they are promoting or selling – despite portraying themselves externally as ‘buyers’ or ‘investors’. For ‘first-time’ Fundless Sponsors, raising equity for a first or second deal can be quite existential to their future, and as a whole this segment has been very opportunistic in taking advantage of the current appetite for co-investments amongst the private markets community: in our experience, the majority of Fundless Sponsors label their transactions as “co-investment opportunities” with a straight face, even as they intend to put little or no equity into them. We recognise that there is nothing preventing a deal stemming from a Fundless Sponsor from outperforming one executed by an upper quartile Lead GP; however the Principal-Agent temptations are orders of magnitude greater, and we therefore set the due diligence / alignment of interest / quality bar extremely high for this category of deals. For example, we differentiate between Fundless Sponsors doing their first or second deal (ie. those that literally have to put food on the table and cover their salaries and overheads) vs those that already have a healthy portfolio, have been backed repeatedly by clients, are putting significant ‘GP commit’ into a deal, and therefore have their franchise, their track records and reputation at stake.

2) Incentives faced by Sources of Co-Investments (Lead GPs, Agents/Brokers, Crowdfunding sites, Secondary exchanges, SPV promoters, etc)

In our discussion above, we explored the incentives to consummate a transaction faced by Lead GPs, funded or unfunded. These are actually distinct and separate from the incentives to syndicate or distribute a co-investment, which are in fact even more stark. Again, the lines between ‘sellers’ and ‘syndicators’ are blurring: typically, a ‘fully funded’ GP – ie. one whose fund is appropriately sized and fit for purpose – will syndicate a transaction when it is slightly too large for their fund, and they wish to right-size the deal. An ‘underfunded’ GP instead requires additional capital in order to complete a transaction. In essence, they are seeking ‘co-underwriters’. Finally, as described above, a Fundless sponsor typically falls into the category of promoter. At the risk of generalising, we rank the risk of Principal-Agent conflict as increasing across the above categorisations for the following reasons:

A fully funded GP typically earns 100% of its compensation from the three sources identified above: carried interest, management fee and GP stake value. Their first moral commitment (when syndicating a deal) is to their existing LPs, as it is market practice for current investors to be offered fee-free carry-free co-investment as a ‘thank you’ for having invested in the fund in the first place. As such, these fully funded GP’s stand to gain nothing from the syndication: in other words, the co-investment is a ‘cost centre’ not a potential ‘profit centre’.

‘Underfunded’ GPs often face similar considerations as fully funded GPs, in that their co-underwriting partnerships or syndications are typically with existing LPs or parties on whom they will not be able to generate fees, hence these syndications are not a promotion but merely an enabler of transactions for their main funds. From time to time at FCP we come across sponsors who are serial syndicators, constantly doing deals larger than their funds allow: we sometimes question why their existing LPs have not chosen to support them with appropriately sized commitments, and therefore note that these GPs may face more ‘promotional’ incentives to grow larger than their appropriately funded brethren.

We have already discussed the sometimes ‘existential’, and sometimes ‘concentrated’ nature of incentives faced by Fundless Sponsors. We also view the recent surge in Placement-Agents representing first-time sponsors, as well as the rise of Secondary exchanges and SPV promoters in the venture space as potential red flags. In our view, these transactions can face a double dose (and if a deal is contemplated with a selling founder/entrepreneur, even a triple dose) of Principal-Agent temptations: none of the parties have much skin in the game, all are essentially sellers / promoters, and each faces immediate and significant windfalls as a result of a concluded transaction.

A word on SPV promoters

At FCP we’ve come to realise that – like it or not – we could be described as being in the “SPV” (Special Purpose Vehicle) business, given our model of providing deal-by-deal co-investment access to our clients. This is a description we’ve historically bristled at for the following reasons:

The phrase does not include the word ‘partnership’, which is fundamental to how we do business. FCP’s entire organisation is designed to focus our team’s minds on our fiduciary duty, ie. to maximise alignment of interest and minimise Principal-Agent temptations, so that we treat our clients’ investments as though they were our own. Our partnerships are structured almost identically to traditional private equity funds: as General Partner, we invest our capital alongside our Limited Partners, and therefore the majority of our compensation occurs only if we achieve a significant profit (over one or more hurdles) on our investors’ capital.

The term ‘special’ connotes an extraordinary, often one-off event, whereas for FCP, our deal-by-deal Limited Partnerships constitute our ‘bread and butter’ offering. We currently have seven SPVs in existence and aim to establish four to six more every year hereafter.

The other SPV participants in Private Markets we’ve come across seem to congregate in the more ‘entrepreneurial’ tech pre-IPO round / founder or early-investor secondaries space where multiple parties are subject to Principal-Agent misalignment. For example, we’ve recently been invited to several unicorn or deca-corn ‘pre-IPO’ SPVs where:

o There was little or even zero ‘GP commitment’ towards the deals, with the promoter (typically an early VC investor or CEO/Founder) sitting on millions of dollars of unrealised gains from earlier investments or stock options granted at much lower valuations;

o Little or no investment analysis or financial modelling was provided, and access to third party due diligence information was minimal (for example, there were no, or at best sparse data rooms, and typical materials contained were promotional in nature); o In the case of Secondaries, sellers were typically the source of due diligence materials and perspectives on the situation, with few checks and balances on what they chose to include;

o Aggressive sales tactics were employed (in one case, we were given 5 days to commit, and told that signing an NDA / performing due diligence meant “missing out on the opportunity”);

o Neither the promoters, their firms nor their vehicles appeared to be regulated in any serious way (our investment advisor Fiduciary Co-investment Partners LLP is UK FCA regulated, and our GP and its partnerships are subject to local JFSC oversight in Jersey);

o Unrealistic upside cases were presented with little discussion of potential downsides: charitably, the risk : reward propositions being offered seemed to us to be more suitable for a co-mingled fund vehicle where such investments with a high loss ratio might be offset by one or two investments with significant upside... as is the case in the VC industry.

Theranos: a simple fraud or an abrogation of fiduciary duty by a series of agents?

Perhaps it’s worth ending these reflections on the recent split verdicts on the 11 charges of fraud against Elizabeth Holmes, the founder of Theranos. This is a textbook case where aggressive tactics used by both a management team (specifically Holmes and her then COO Sunny Balwani), and a number of introducers, secondary agents and SPV promotors, enabled if not encouraged a highly in-transparent management team to continue down their slippery and ultimately fraudulent slope.

To recap, Theranos raised hundreds of millions of dollars in the space of 10 years from a ‘who’s who’ list of investors / Board Members including Rupert Murdoch, Larry Ellison, Carlos Slim, the Walton Family, former Secretaries of State Henry Kissinger and George Schultz, Secretary of Education De Vos, and Secretaries of Defence Jim Matthis and William Perry, with the majority of the Series C-2 and four of the top seven investors introduced via a single agent / promoter [5],[6]. Recognisable VC firms and proper institutional due diligence, however, were conspicuous in their absence:

“Ms. Holmes … was an outlier as a founder because she failed to raise funding from the top-tier venture-capital firms and wasn’t part of Silicon Valley’s inner circle…the secrecy she got away with wouldn’t be tolerated by most investors [7]”

One family office “invested about $1.2 million in Theranos in 2006, after a five-minute phone call with Holmes [8]”

Holmes at one point let over two years pass without providing an update to her investors [9]

Despite being denied answers to traditional due diligence requests, many investors proceeded and one even wrote a subservient thank you note [10].

With hindsight, is it truly a co-incidence that Holmes’ focus was on “high-quality families” [11] - rather than VC firms - to fill the fundraising rounds that would bring her one step closer to an IPO / liquidity event? Whilst the introducers, agents and SPV promoters providing ‘exclusive access’ to the company’s latest rounds may also have been unwitting victims of her fraud… several created millions of dollars of agency profits and option value for themselves along the way.

Conclusions

Whilst we agree it’s not fair to paint all fundless sponsor deals, SPVs or venture ‘unicorns’ with the same brush as Theranos, the reality we’ve experienced is that very similar sales tactics are increasingly being used around these types of opportunities by promoters and their agents looking to tap into investors’ FOMO.

To use a somewhat simplistic analogy, at FCP we view ourselves as being in the business of prescribing vitamins, while many of the deals we’ve come across seem to emanate from promotors who could be argued to be dealing in the equivalent of anabolic steroids or even Class-A drugs. We specifically seek out 'institutional grade' transactions on the lower end of the risk spectrum (at least relative to other deal-by-deal investments we come across) which we then present as a potential health supplement to our investors' diversified private markets portfolios. In contrast, many parties are using aggressive sales tactics to sell unregulated products purporting to offer 'quick highs' whilst obfuscating their inherently greater risks. These are then labelled cynically as ‘co-investments’, despite lacking the core ingredient of ‘alignment of interest’ that has historically underpinned the institutional side of the asset class.

At FCP, we literally force ourselves to ‘miss out’ every day on opportunities when they don’t match our key simple gating criteria:

Alignment with top tier, preferably top quartile, professional institutional investors (at the same price at the same terms), who’s track records are at stake and who shouldn’t ‘need’ to do a deal, nor have significant financial incentives to syndicate it

Access to ‘institutional grade’ due diligence, preferably from multiple parties

Sufficient time for FCP and our clients to conclude due diligence, with no reasonable questions left unanswered

In 2021, we reviewed a record 110+ co-investment opportunities, although we pursued <10% in depth and transacted on only two of them. Almost every day we come across opportunities to invest in higher risk deals that appeal to our FOMO, but, instead, we force ourselves to focus on sourcing and identifying only the most ‘institutional grade’ co-investments (the aforementioned ‘vitamins’). We believe that maximising alignment with sophisticated institutional Lead GPs and having access to their due diligence is the best protection we and our investors can rely on.

From a distribution perspective, we could certainly generate shorter term revenues and profits by pursuing an ‘agency model’, based on market standard up-front fees. Instead, we have opted to take a ‘delayed gratification’ approach to building wealth for and alongside our clients on a consistent basis, over the long term. We always invest alongside our clients on day one, and our carried interest weighted fee model implies that our firm will outperform the potential agency fees we have forgone only in cases where our exits are successful and outperform the hurdle rates we offer to protect our investors.

Our conclusions and recommendations to you are therefore as follows:

Try not to get confused between Principals (fully and partially funded GPs) and Agents (secondary exchanges, introducers, fundless sponsors, unregulated SPV promotors, etc)

Agents may be necessary and even well-intentioned, but neither their motives nor their promotional materials or research should be assumed to be fully aligned with your interests

If you don’t have the resources to do your own due diligence, piggy-back on someone else’s

Details matter: question the motives of and dig deeply into the economics and incentives of your counterparty.

We look forward to continuing our dialogue with you on future institutional grade co-investments, and we wish you a happy and healthy rest of 2022!

[5] Lawyer Daniel Mosley and His Clients Put $384 Million Into Theranos; Nov 2nd, 2021, WSJ.com

[6] Estate Lawyer Describes How He Became Theranos Investor Matchmaker; Nov 3rd, 2021, WSJ.com

[7] With Elizabeth Holmes’s Conviction, Venture Capitalists Distance Themselves From Theranos; Nov 5th, 2021, WSJ.com

[8] Elizabeth Holmes will take your $1.2 million but not your phone calls - The Verge; Nov 15th, 2021, theverge.com

[9] https://files.cand.uscourts.gov/files/18-CR-258%20USA%20v.%20Holmes/

[10] Theranos trial exposes investors’ carelessness in dealing with Holmes; Nov 5, 2021, The Irish Times.

[11] https://www.cnbc.com/2021/11/02/attorney-of-henry-kissinger-put-6-million-in-theranos-due-to-holmes.html

Disclaimer

The description herein of the approach of Fiduciary Co-investment Partners LLP and FCP Private Markets GP Limited (together “FCP”) and the targeted characteristics of their respective strategies and investments are based on current expectations and should not be considered definitive or a guarantee that any future approaches, strategies, and resulting investment(s) will, in fact, possess these characteristics.

FCP pursue a deal-by-deal funding model and so our Limited Partners’ and clients’ own decision making processes have a material impact on the composition, scale and weighting or our co-investment portfolio, including whether we consummate a particular co-investment in the first place. Performance results of the weighted FCP portfolio are presented for information purposes only and reflect the impact that material economic and market factors had on Limited Partners’ particular appetites and decision making processes. No representation is being made that any future investor or portfolio will or is likely to achieve profits or losses similar to those shown. Due to a disparity in fees across FCP Limited Partners’ investments, MoiC and IRR results are shown Gross of management fees and carried interest.

Weighted portfolio based on actual final amounts invested by FCP advised or managed accounts. As per above, the composition of this portfolio was a function of Limited Partners’ due diligence processes and decisions to commit to a particular transaction as much as FCP’s own decisions and advice in relation to a particular transaction, and as such should not be seen as reflective of FCP’s track record.

Performance results are unaudited and do not reflect actual results of any accounts advised by Fiduciary Co-investment Partners LLP or managed by FCP Private Markets GP Limited. As no single FCP client (outside of the FCP team) has invested in all of our transactions, aggregated MoICs and IRRs as shown for theoretical purposes only. We also show a hypothetical “un-weighted portfolio” which assumes an identical weighting to each investment as if client had invested equally, and at the same time, in every deal. Finally, we also show a hypothetical “mature portfolio” which consists of transactions over 12 months old where lead GPs and FCP have begun to provide quarterly valuations other than holding them at cost.

All investments are unrealised and past performance does not guarantee future results.

Inherent limitations of hypothetical performance may include: 1) hypothetical results are generally prepared with the benefit of hindsight; 2) hypothetical results do not represent the impact that future material economic and market factors might have on FCP’s or its clients’ decision-making processes; 3) there are numerous additional factors related to markets in general, many of which cannot be fully accounted for in the preparation of hypothetical performance results and all of which may adversely affect actual investment results.

The graphs, charts and other visual aids are provided for informational purposes only. None of these graphs, charts or visual aids should be used to make investment decisions. No representation is made that these will assist any person in making investment decisions and no graph, chart or other visual aid can capture all factors and variables required in making such decisions.

This report is for informational purposes only and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy or investment product. Our research for this report is based on current public information that we consider reliable, but we do not represent that the research or the report is accurate or complete, and it should not be relied on as such. Our views and opinions expressed in this report are current as of the date of this report and are subject to change. Any reproduction or other distribution of this material in whole or in part without the prior written consent of Fiduciary Co-investment Partners LLP is prohibited